Sometimes called a stop loss, stop order or stop market order, this tool is an automatic instruction to sell an open position when the price drops to a pre-set losing limit, ensuring your losses do Basically, a stop–loss order is exactly what its name suggests — it’s used to stop losses. If your forex trades go in the opposite direction to what you want, stop losses will ensure you’re ‘stopped’ out when the price reaches your maximum loss. It’s important to use stop–loss orders for Definition of:Stop Loss Orderin Forex Trading. A trade order to sell a currency when the price reaches or falls below the specified price. This is used to limit loss, usually when the price can not be actively monitored by the trader

What is a Stop Loss? - blogger.com

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here.

Note: Low and High figures are for the trading day. Market movements can be unpredictable, and the stop loss is one of the few mechanisms that traders have to protect against excessive losses in the forex market.

Stop losses in forex come in different forms and methods of application. This article will outline these various forms including static stops and trailing stops, as well as highlighting the importance of stop losses in forex trading. A forex stop loss is a function offered by brokers to limit losses in volatile markets moving in a contrary direction to the initial trade.

This function is implemented by setting a stop loss level, a specified amount of pips away from the entry price. A stop loss can be attached to long or short trades making it a useful tool for stop loss forex meaning forex trading strategy.

Stops are critical for a multitude of reasons, but it can really be boiled down to one thing: we can never see the future. Regardless of how strong the setup might be, or how much information might be pointing in the same direction — future currency prices are unknown to the market, and each trade is a risk.

In the DailyFX Traits of Successful Traders research, this was a key finding — traders actually do win in many currency pairs the majority of the time. The chart below shows some of the more common pairings. As you can see, stop loss forex meaning, traders were successfully winning more than half the time in most of the common pairings, stop loss forex meaning, but because their money management was often bad they were still losing money on balance, stop loss forex meaning.

Traders lost much more when they were wrong in red than they made when they were right blue. In the article Why do Many Traders Lose MoneyDavid Rodriguez explains that traders can look to address this problem simply by looking for a profit target at least as far away as the stop-loss. That is, if a trader opens a position with a 50 pip stop, look for — as a minimum — a 50 stop loss forex meaning profit target.

This way, if a trader wins more than half the time, they stand a good chance at being profitable, stop loss forex meaning. Traders can set forex stops at a static price with the anticipation of allocating the stop-loss, and not moving or changing the stop until the trade either hits the stop or limit price.

The ease of this stop mechanism is its simplicity, and the ability for traders to ensure that they are looking for a minimum one-to-one risk-to-reward ratio. This trader wants to give their trades enough room to work, without giving up too much equity in the event that they are wrong, so they set a static stop of 50 pips on every position that they trigger.

They want to set a profit target at least as large as the stop distance, so every limit order is set for a minimum of 50 stop loss forex meaning. If the trader wanted to set a stop loss forex meaning risk-to-reward ratio on every entry, they can simply set a static stop at 50 pips, and a static limit at pips for every trade that they initiate.

Some traders take static stops a step further, and they base the static stop distance on an indicator such as Average True Range. The primary benefit behind this is that traders are using actual market information to assist in setting that stop. So, if a trader is setting a static 50 pip stop loss with a static pip limit as in the previous example — what does that 50 pip stop mean in a volatile market, and what does that 50 pip stop mean in a quiet market?

If the market is quiet, 50 pips can be a large move and if the market is volatile, those same 50 pips can be looked at as a small move. Using an indicator like average true range, or pivot pointsor price swings can allow traders to use recent market information to more accurately analyze their risk management options. Average True Range can assist traders in setting stop s using recent market information. We walk through such a mechanism in our article on Managing Risk with ATR Average True Range.

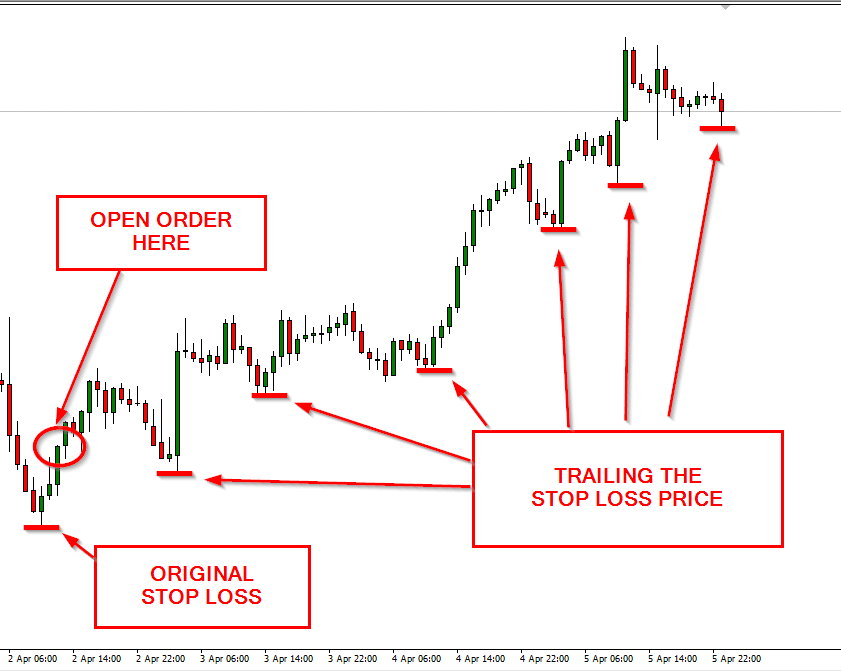

For traders that want the upmost stop loss forex meaning, forex stops can be moved manually by the trader as the position moves in their favor. The chart below highlights the movement of stops on a short position. As the position moves further in favor of the trade lowerthe trader subsequently moves the stop level lower, stop loss forex meaning. When the trend eventually reverses and new highs are madethe position is then stopped out. Trader adjusting stops to lower swing-highs in a strong down-trend.

Take a look at Trading Trends by Trailing Stops with Price Swings for more information on how to implement the trailing stop. It is important to note that some jurisdictions allow brokers to enforce the trailing stop function. If the trade moves up to 1. This break-even stop allows the trader to remove their initial risk in the trade. Break-even stops can assist traders in removing their initial risk from the trade.

Traders can also set trailing stops so that the stop will adjust incrementally, stop loss forex meaning. For example, traders can set stops to adjust for every 10 pip movement in their favor. This process will continue until such time as the stop level is hit or the trader manually closes the trade. If the trade reverses from that point, the trader is stopped out at 1. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk.

Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website.

Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min.

P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs stop loss forex meaning what impacts price movements.

Commodities Our guide explores the most traded commodities stop loss forex meaning and how to start trading them, stop loss forex meaning. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies stop loss forex meaning trade and how to get started. Economic Calendar Central Bank Calendar Economic Calendar. Consumer Confidence JUN, stop loss forex meaning.

P: R: Housing Starts YoY MAY. P: R: 7. GDP Growth Rate YoY Final Q1. F: Trading courses Forex for Beginners Forex Trading Basics Stop loss forex meaning Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact.

of clients are net long. of clients are net short. Long Short. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Stop loss forex meaning Setup Oil - US Crude. Crude Oil Price Forecast: A Slow and Steady Grind Higher, but Red Flag Appears Wall Street. News Dow Jones Steady as Tech Stocks Rally, Hang Seng May Rebound US Yields Going Which Way?

More View more. Previous Article Next Article. Using Stop Loss Orders in Forex Trading Warren VenketasMarkets Writer. What is a stop loss?

Take Profit \u0026 Stop Loss (EXPLAINED- MUST SEE)

, time: 11:41Using Stop Loss Orders in Forex Trading

Definition of:Stop Loss Orderin Forex Trading. A trade order to sell a currency when the price reaches or falls below the specified price. This is used to limit loss, usually when the price can not be actively monitored by the trader A well-developed exit strategy, well-defined stop-loss, is an essential part of any forex trading strategy. Market condition changes during the time, and a strong market reaction can ruin trading performance without a correctly estimated stop loss level. Forex without stop lossEstimated Reading Time: 8 mins Feb 25, · What is a stop loss? A forex stop loss is a function offered by brokers to limit losses in volatile markets moving in a contrary direction to the initial trade. This function is implemented by Estimated Reading Time: 6 mins

No comments:

Post a Comment