Binary option pricing: simulation implementation. The value of a Binary option can be calculated based on the following method: Step 1: Determine the return μ, the volatility σ, the risk free rate r, the time horizon T and the time step Δt. Step 2: Generate using the formula a price blogger.comted Reading Time: 2 mins 04/11/ · Formula. The call option value using the one-period binomial model can be worked out using the following formula: c c 1 c 1 r. Where π is the probability of an up move which in determined using the following equation: 1 r d u d. Where r is the risk-free rate, u equals the ratio the underlying price in case of an up move to the current price of Estimated Reading Time: 4 mins S = #current_price K = #ATM strike v = #annualized volatility r = #interest rate T = #days remaining (annualized) d2 = (log (S/K) + (r - * v**2) * T) / (v*sqrt (T)) print exp (-r * T) * blogger.com (d2) black-scholes binary-options. Share. Improve this question

Binary option pricing - Breaking Down Finance

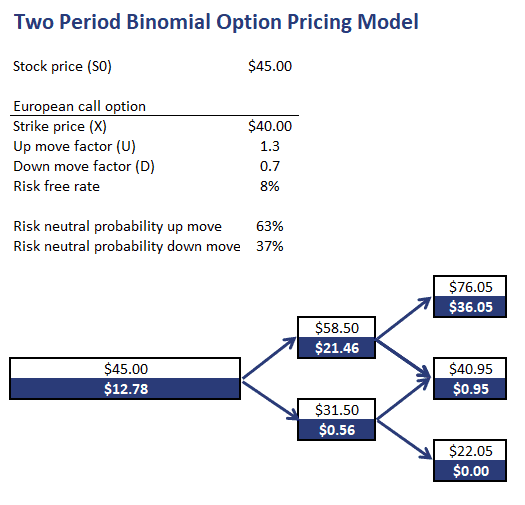

In financethe binomial options pricing model BOPM provides a generalizable numerical method for the valuation of options.

Essentially, the model uses a "discrete-time" lattice based model of the varying price over time of the underlying financial instrument, addressing cases where the closed-form Black—Scholes formula is wanting.

Binary option price formula binomial model was first proposed by William Sharpe in the edition of Investments ISBN X[1] and formalized by CoxRoss and Rubinstein in [2] and by Rendleman and Bartter in that same year. For binomial trees as applied to fixed income and interest rate derivatives see Lattice model finance § Interest rate derivatives.

The Binomial options pricing model approach has been widely used since it is able to handle a variety of conditions for which other models cannot easily be applied. This is largely because the BOPM is based on the description of an underlying instrument over a period of time rather than a single point.

As a consequence, it is used to value American options that are exercisable at any time in a given interval as well as Bermudan options that are exercisable at specific instances of time. Being relatively simple, the model is readily implementable in computer software including a spreadsheet. Although computationally slower than the Black—Scholes formulait is more accurate, particularly for longer-dated options on securities with dividend payments.

For these reasons, various versions of the binomial model are widely used by practitioners in the options markets. For options with several sources of uncertainty e, binary option price formula. When simulating a small number of time steps Monte Carlo simulation will be more computationally time-consuming than BOPM cf.

Monte Carlo methods in finance, binary option price formula. However, the worst-case runtime of BOPM will be O 2 nwhere n is the number of time steps in the simulation. Monte Carlo simulations will generally have a polynomial time complexitybinary option price formula, and will be faster for large numbers of simulation steps. Monte Carlo simulations are also less susceptible to sampling errors, binary option price formula, since binomial techniques use discrete time units, binary option price formula.

This becomes more true the smaller the discrete units become. The binomial pricing model traces the evolution of the option's key underlying variables in discrete-time. This is done by means of a binomial lattice Treefor a number of time steps between the valuation and expiration dates, binary option price formula.

Binary option price formula node in the lattice represents a possible price of the underlying at a given point in time. Valuation is performed iteratively, starting at each of the final nodes those that may be reached at the time of expirationand then working backwards through the tree towards the first node valuation date.

The value computed at each stage is the value of the option at that point in time. The CRR method ensures that the tree is recombinant, i. if the underlying asset moves up and then down u,dthe price will be the same as if it had moved down and then up d,u —here the two paths merge or recombine. This property reduces the number of tree nodes, and thus accelerates the computation of the option price.

This property also allows the value of the underlying asset at each node to be calculated directly via formula, and does not require that the tree be built first.

The node-value will be:. At each final node of the tree—i. at expiration of the option—the option value is simply its intrinsicor exercise, value:. Once the above step is complete, the option value is then found for each node, starting at the penultimate time step, and working back to the first node of the tree the valuation date where the calculated result is the value of the option. Binary option price formula overview: the "binomial value" is found at each node, using the risk neutrality assumption; see Risk neutral valuation.

If exercise is permitted at the node, then the model takes the greater of binomial and exercise value at the node. In calculating the value at the next time step calculated—i. The aside algorithm demonstrates the approach computing the price of an American put option, although is easily generalized for calls and for European and Bermudan options:.

Similar assumptions underpin both the binomial model and the Black—Scholes modeland the binomial model thus provides a discrete time approximation to the continuous process underlying the Black—Scholes model. The binomial model assumes that movements in the price follow a binomial distribution ; for many trials, this binomial distribution approaches the log-normal distribution assumed by Black—Scholes.

In this case then, for European options without dividends, the binomial model value converges on the Black—Scholes formula value as the number of time steps increases. In addition, when analyzed as a numerical procedure, the CRR binomial method can be viewed as a special case of the explicit finite difference method for the Black—Scholes PDE ; see finite difference methods for option pricing.

From Wikipedia, the free encyclopedia. Numerical method for the valuation of financial options. Under the risk neutrality assumption, today's fair price of a derivative is equal to the expected value of its future payoff discounted by the risk free rate. The expected value is then discounted at rthe risk free rate corresponding to the life of the option.

This result is the "Binomial Value". It represents the fair price of the derivative at a particular point in time i, binary option price formula. at each nodegiven the evolution in the price of the underlying to that point. It is the value of the option if it were to be held—as opposed to exercised at that point. Depending on the style of the option, evaluate the possibility of early exercise at each node: if 1 the option can be exercised, and 2 the exercise value exceeds the Binomial Value, then 3 the value at the node is the exercise value.

For a European optionthere is no option of early exercise, and the binomial value applies at all nodes. For an American optionsince the option may either be held or exercised binary option price formula to expiry, the value at each node is: Max Binomial Value, Exercise Value.

For a Bermudan optionthe value at nodes where early exercise is allowed is: Max Binomial Value, Exercise Value ; at nodes where early exercise is not allowed, only the binomial value applies. Sharpe, Biographicalbinary option price formula, nobelprize.

Journal of Financial Economics. CiteSeerX doi : Rendleman, Jr. and Brit J. Journal of Finance Joshi March A Synthesis of Binomial Option Pricing Models for Lognormally Distributed Assets Archived at the Wayback Machine. Journal of Applied Finance, Vol. Derivatives market. Derivative finance. Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Binary option price formula interest rate Strike price the Greeks Volatility.

American Bond option Call Employee stock option European Fixed income FX Option styles Put Warrants. Asian Barrier Basket Binary Chooser Cliquet Binary option price formula Compound Forward start Interest rate Lookback Mountain range Rainbow Swaption. Collar Covered call Fence Iron butterfly Iron condor Straddle Strangle Protective put Risk reversal.

Back Bear Box Bull Butterfly Calendar Diagonal Intermarket Jelly roll Ratio Vertical. Binomial Black Black—Scholes Finite difference Garman—Kohlhagen Lattices Margrabe Put—call parity MC Simulation Real options Trinomial Vanna—Volga. Amortising Asset Basis Binary option price formula variance Constant maturity Correlation Credit default Currency Dividend Equity Forex Forward Rate Agreement Inflation Interest rate Overnight indexed Total return Variance Volatility Year-on-Year Inflation-Indexed Zero Coupon Inflation-Indexed Zero Coupon Swap.

Forwards Futures. Contango Commodities future Currency future Dividend future Forward market Forward price Forwards pricing Forward rate Futures pricing Interest rate future Margin Normal backwardation Perpetual futures Single-stock futures Slippage Stock market index future.

Commodity derivative Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Collateralized debt obligation CDO Constant proportion portfolio insurance Contract for difference Credit-linked note CLN Credit default option Credit derivative Equity-linked note ELN Equity derivative Foreign exchange derivative Fund derivative Fund of funds Interest rate derivative Mortgage-backed security Power reverse dual-currency note PRDC. Consumer debt Corporate debt Government debt Great Recession Municipal debt Tax policy.

Categories : Financial models Options finance Mathematical finance Models of computation Trees data structures. Hidden categories: Webarchive template wayback links Articles with short description Short description matches Wikidata All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from January Navigation menu Personal tools Not binary option price formula in Talk Contributions Create account Log in.

Namespaces Article Talk. Views Read Edit View history. Main page Contents Current events Random article About Wikipedia Contact us Donate. Help Learn to edit Community portal Recent changes Upload file. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Wikidata item. Download as PDF Printable version.

Deutsch Eesti Français Italiano עברית 日本語 Norsk bokmål Polski Українська Edit links. function americanPut T, S, K, r, sigma, q, n { ' T expiration time ' S stock price ' K strike price ' q dividend yield ' n Terms Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.

The most reliable strategy for binary options

, time: 7:07finance - Pricing binary options - Quantitative Finance Stack Exchange

20/07/ · Formula. A binary call option pays 1 unit when the price of the underlying (asset) is greater than or equal to the exercise price and zero when it is otherwise. This is expressed by the following formula: $$ \text{Binary Call Option Payoff} \\ =\left\{\begin{\text{matrix}}\text{1} \text{,} \text{Underlying’s Price}\ \geq\ \text{Exercise Price}\\\text{0} \text{,} \text{Exercise Price} Estimated Reading Time: 2 mins 04/11/ · Formula. The call option value using the one-period binomial model can be worked out using the following formula: c c 1 c 1 r. Where π is the probability of an up move which in determined using the following equation: 1 r d u d. Where r is the risk-free rate, u equals the ratio the underlying price in case of an up move to the current price of Estimated Reading Time: 4 mins A binary option pays an amount of money if an event takes place and zero otherwise. Binary options are usually used to insure portfolios against large drops in the stock market. On March 25, the price of a binary option that pays one dollar if the S&P falls by more than 10% (e.g., % and below) within one year from today is

No comments:

Post a Comment