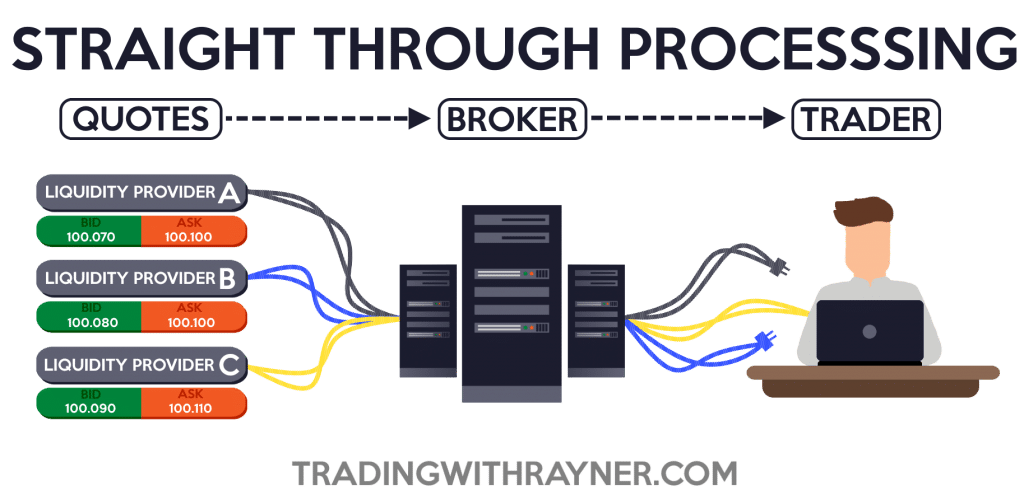

What is an STP account? STP (Straight Through Processing) account represents no dealing desk technology where all trading orders are routed directly to liquidity providers using DMA (Direct Market Access). Using an STP account, all trades will be routed first to the liquidity pool, and then all orders will be filled at the best possible price The online forex trading industry has a variety of acronyms and terminology that can often be confusing to newcomers, STP being one of them. Because forex & CFD trading is relatively new when compared to the stock market or futures, it’s challenging to find a reliable source of information that adequately explains market terminology such as Straight Through Processing also known as blogger.comted Reading Time: 1 min 8/17/ · Straight Through Processing (STP): This type of broker typically routes some or all of your orders directly to the market. This is a hybrid model between MM and ECN. Some brokers though say they are STP while they are actually MM, you can never tell and sometimes they do a bit of both – MM for losers and STP for blogger.coms: 4

The Difference Between an STP and an ECN Forex Broker Explained - Admirals

An STP representative is like an ECN merchant, where all customer positions are passed what is stp forex to the market through interbank trade houses or liquidity suppliers like banks.

STP Forex dealers guarantee an exceptionally straightforward exchanging climate without any irreconcilable circumstance with its customers. STP Straight Through Processing account represents no dealing desk technology where all trading orders are routed directly to liquidity providers using DMA Direct Market Access. Using an STP account, all trades will be routed first to the liquidity pool, and then all orders will be filled at the best possible price, what is stp forex.

Notwithstanding, STP records ought not to be considered as a genuine option in contrast to ECN accounts. ECN accounts are absolutely a non-managing work area model that empowers merchants to exchange the business sectors ongoing by sending orders straightforwardly to the market. To a greater degree, STP accounts are viewed as a crossbreed of the ECN and market creator managing work area models.

All things considered, STP Forex exchanging accounts are ending up being more appealing than conventional managing work area accounts because of the assortment of benefits that merchants appreciate. Yet, STP likewise has a couple of downsides over the further developed ECN accounts. Owing to several parameters, we can discriminate between many kinds of Forex brokers.

Forex brokers may typically be separated into categories by:. Market producer representatives are managing work area organizations that ingest customer orders, and either passes them inside to different customers or take the far edge of the exchange.

Because of the 24 hours nature of the FX market, representatives experience variable liquidity and conflicting volumes for the duration of the day.

Most market what is stp forex resort to strategies, for example, cost control, disengaging the cost takes care of, expanding the spreads, taking care of requests at ominous value what is stp forex, and in any event, what is stp forex to change customer orders without their assent. Thusly, a larger part of brokers will, in general, lose cash with market producers. All customer orders are passed straightforwardly to the liquidity supplier, and the business sectors by and large ingest the request with no mediation from the representative, what is stp forex.

STP representatives bring in cash from the spreads charged for each exchange, which is useful for the two players, all things considered, what is stp forex.

Now and again, managing work area what is stp forex will set aside a great deal of effort to take care of requests, which can go from a few seconds to minutes. Dealers may likewise confront stage-down occasions, which can keep them from opening or shutting their situations under great conditions.

Despite what might be expected, STP accounts help decrease the number of re-cites as a dealer is associated with a bigger liquidity pool, and orders are filled moderately quicker than regular market producer accounts. One of the fundamental benefits of STP dealers is how orders are filled all the more rapidly, and exchange execution is consistent, which thusly causes merchants to exploit economic situations without the intermediary meddling in any way, what is stp forex.

Many times as market makers, we typically mean DD brokers. They generally create money by spreads or by liquidity provision. Before taking a countertrade or handing it over to a liquidity supplier, they even attempt to find a suitable short or long order with their other customers. They are proven to produce artificial quotations; however, on a proportionate basis, orders are completed, what is stp forex.

NDD brokers employ software without the need for a dealing desk and channel trading orders straight to liquidity suppliers instead of a DD broker. With stronger and quicker loads, this helps consumers to enter actual markets.

It is a connection what is stp forex consumers and suppliers of liquidity, and if an order has to what is stp forex completed, there are really no re-quotes. We distinguish between both the STP and the ECN, two main types of NDD Forex Brokerage firms.

A no dealing desk is required for the Straight Through Processing STP system. Both requests are directed to the liquidity suppliers of the broker, and rates are handled at the bid or ask rate issued by the suppliers of liquidity.

Liquidity suppliers in this situation are hedge funds, large banks, plus investors who essentially serve as counterparties to each transaction. The STP currency broker typically seems to have an internal liquidity stream represented by multiple suppliers of liquidity who negotiate what is stp forex the highest bid or ask ranges for STP broker trades. In a wider context, STP implies that instead of a dealing desk reprocessing transaction, the broker firm plays a quiet link supplier between the client and the dealer.

DMA refers to Entry from the Direct Markets. DMA applies when dealers specifically transfer their customer requests to their liquidity pool; thus, transactions are fulfilled at the highest possible price, with the dealer spreading only a slight mark-up. The brokerage with one of the most adjustable spreads is the one that you can always reach for. The what is stp forex with this is that the dealer with the most flexible spreads is free to choose from their own collection the winning offer from one of the liquidity suppliers, and the better spread from some other liquidity supplier.

That clearly gives their customers the finest spread. The STP implementation clearly goes with no requotes, and owing to its lightning pace; it is quite perfect for traders that like to scalp and exchange the information. Both STP and ECN Forex dealers seem to be several links, but the only real distinction is navigation. As described before, the STP can negotiate with various liquidity suppliers out of the liquidity pool, whereas the ECN functions as some hub.

This hub serves efficiently as the significant funding outlet, what is stp forex it is embodied by banks, fund managers, what is stp forex, and all the big market participants. To locate counterparties with the instructions they seem unable to manage individually, they become all intertwined.

Another distinction is that ECN trade is often limited at a nominal lot size of 0. Thus, as a response, a hybrid model was constructed. More modest representatives likewise utilize STP spans to interface their dealers to huge intermediaries, who will, what is stp forex, thus, decide to either what is stp forex the merchant straightforwardly to the market or choose to ingest the exchanges inside, what is stp forex.

STP, then again, permits intermediaries to take advantage of a bigger liquidity pool that is given either by the worldwide trade houses or by bigger specialists.

In this way, STP Forex representatives are not totally liberated from irreconcilable situations. Yet, STP accounts give a more prominent suspicion that all is well and good than conventional market producer merchants. STP and ECN have a few comparable qualities. Yet, a few dealers lean toward STP in its unadulterated structure because of the absence of a commission for each exchange normally connected with ECN accounts.

Most institutional merchants open ECN records to appreciate more tight spreads at the expense of a commission for each exchange charged as a level of the exchanged parcels. Hawkers what is stp forex additionally known to exchange with ECN conditions to get in and out of the business sectors as fast as could really be expected and appreciate more tight spreads for better market execution.

Hence, if commission-streamlined commerce is your need, STP records can give a larger number of benefits than ECN accounts. ECN has a high ground over ordinary STP accounts as brokers are presented to the real liquidity accessible on the lookout regarding exchange execution speed. STP records might be crossed over to bigger specialists or trade houses, resulting in more slow exchange execution times and a couple of re-cites. ECN accounts have negligible occurrences of re-statements.

A few dealers may discover ECN to be more costly from a commission perspective. However, they might be astounded to discover that ECN records may end up being more prudent over the long haul.

ECN accounts give the best-exchanging conditions; in any case, STP accounts are not a long way behind the speed of exchanging and the general exchanging climate. Despite your decision, what is stp forex pick a Forex intermediary that a legitimate administrative office directs and guarantee that the agent of your decision has a decent standing on the lookout.

Regularly, the representative has numerous liquidity suppliers: either banks or bigger intermediaries producing its own offer and ask cost.

The STP execution likewise implies there is no re-statement or deferral in taking care of requests. The innovation executes in extraordinary speed, sorts cite among the contribution and takes care of requests at best accessible cost adding-on little fixed markup normally 1 pip to the statement.

A mix of the ECN and the STP can be called the Hybrid account model. Generally, dealers are willing to offer excellent client support, training, and multiple industry assessments for this arrangement. A complete electronic Forex trading operation is possible by combining the ECN and STP versions, what is stp forex. For Currency traders, nevertheless, the hybrid version is an excellent choice, what is stp forex.

Brokers prevent market manipulation with both the STP and the ECN versions. For dealers and brokers, too, that is a winning scenario. Brokers would not want traders to fail because the more customers choose their platform to sell, they can gain money from spread or commission. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us. Table of Contents.

Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. The Best 4h Forex Strategy Silver Price History — Price of Silver Over Time Stock Exchange Trading Hours. Related posts: ECN Account Broker — ECN vs Standard Account Forex4you Pro-STP account what is stp forex new currency pairs IC markets Account Verification Procedure Discretionary vs Non Discretionary Trading Account Difference Between Forex Demo and Real Account Fxpro Account Types What is a Forex Account?

How to Change Password on Hotforex account? How to Change Leverage on Hotforex account? How to Open Hotforex Live Account?

IFC Markets Real Account. Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up, what is stp forex. Get newsletter. Spanish language — Hindi Language.

blogger.com :فارکس بروکرهای خطرناک

, time: 1:16:23Straight-Through Processing (STP) Definition

STP TRADING broker willingly invites all scalpers to test the broker's fast platform and fixed spreads in gold and other floating symbols to find out the truth of our words. Free Training. STP Trading Broker represents FREE Forex Training Classes We are specialists in leveraged trading 6/14/ · STP stands for Straight Through Processing, a concept that is often misunderstood by those new to forex trading. Those new to the FX industry will often hear the terms STP (Straight Through Processing) and NDD (No Dealing Desk) thrown around quite blogger.comted Reading Time: 4 mins Forex is the science and art of trading different currencies and making a profit through it. In simple terms, Forex is an international exchange for trading currencies, stocks and commodities. Forex is a Latin term derived from the two words Foreign Exchange, which means the exchange of foreign currencies

No comments:

Post a Comment