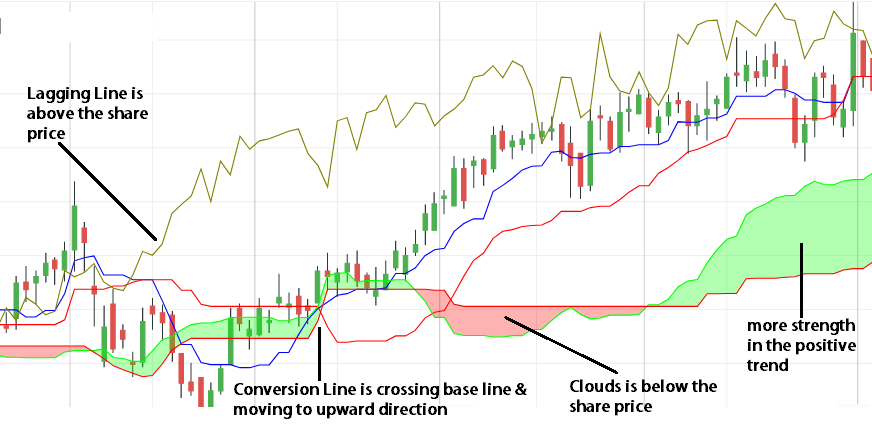

Dec 22, · Ichimoku Kinko Hyo – The Power of Trends. Ichimoku is a trading system that originated in Japan. Developed by journalist Goichi Hosoda, it is designed to help you identify and trade with the dominant trend.. The lines look quite complicated on the chart, but you can easily use them as part of an automated trading strategy May 18, · In this following discussion we are going to talk about ichimoku cloud strategy that ran eves to make without any trouble. This is a most popular and technical tool and indicator that have great command in analysis lines that occur in chart which is about trading and its Ichimoku Cloud Kinko blogger.com market indicator is most important that can access to use in market Jul 09, · The Ichimoku Cloud, otherwise called Ichimoku Kinko Hyo, is a flexible indicator that characterizes support and resistance, distinguishes bias heading, measures momentum, and gives trading signals. Below we will provide you with an idea about Ichimoku Cloud and its basic trading strategy

3 Profitable Ichimoku Trading Strategies - Tradinformed

What happens when we combined Ichimoku and Fibonacci? We get a powerful trend pullback strategy which makes it much safer for us to follow a trend. Essentially, we will be making entries and trading on pivot points identified by the Fibonacci levels. For trend trading, the Ichimoku trading system is no ichimoku forex strategy one of the most widely accepted trading system.

Long term traders prefer to make use of the Ichimoku trading indicator as a way to capture trends in the markets which often persist over a prolonged period of time. While the Ichimoku system is in itself a complete trading system, it is by no means a failsafe method as price tends to post sharp corrections and could result in false signals.

In order to avoid this, applying the Fibonacci tool to the Ichimoku trading system can be a versatile way to enter the trends on ichimoku forex strategy retracement. Based on simple rules and on the fact that price never tends to move in one straight direction, the Fibonacci tool can be used to compliment the trend signals shown by the Ichimoku trading system. In this trading strategy, we present a rather simple way for traders to take up positions on a retracement after a trend is confirmed.

We make use of the Ichimoku trading indicator in its entirety, ichimoku forex strategy. This includes using the Ichimoku Cloud, the Chikou Span, Tenkan and Kijun Sen. After applying the Ichimoku system to the chart, ichimoku forex strategy, the next step is to wait for buy and sell signals as outlined below. Wait for price to break above the Ichimoku Cloud from below.

Prices should rise steadily before starting a retracement. When prices start to retreat from the first high above the cloud, using the Fibonacci tool, connect the high and the low. Wait for price to retrace the At Exit at the Wait for price ichimoku forex strategy break the cloud from ichimoku forex strategy. Prices need to continue to decline steadily before retracing the move.

Using the Fibonacci tool, connect the high and low and wait for price to retrace to At this point, traders can sell, based on the regular Ichimoku trading signals, which is a bearish crossover of the Tenkan and Kijun Sen and prices trading below the cloud. Ichimoku and Fibonacci — Buy Signal. In the first chart above, we notice how prices were trending lower at the left of the chart.

At point 1, prices start to move higher and eventually break above the Ichimoku cloud before ichimoku forex strategy to retrace from point 2, ichimoku forex strategy. Using the Fibonacci tool the low and the highs are connected. Prices complete their retracement near We wait for the Tenken and Kijun sen to make a bullish crossover where a long position is taken with stops near the The trade is then closed when prices reach the Ichimoku and Fibonacci — Sell Signal.

The sell signal example in the chart above shows prices breaking down below the Cloud, marked by points 1 and 2. The Fibonacci tool is used to measure this move as we anticipate a retracement to the Here, the Tenken sen and Kijun sen make a bearish crossover and when ichimoku forex strategy close below the cloud, the short position is taken which is then closed out when price hits the As illustrated above, the Ichimoku and Fibonacci trading system is rather unique, in that the Fibonacci tool helps traders to compliment the trend ichimoku forex strategy system using the Ichimoku trading indicator.

When trades do get invalidated by hitting the stop loss, traders would be confident to know that prices are continuing to move in the opposite direction. The fixed stop loss and take profit levels ensures that there is no ambiguity involved when using this trading system. If you like to learn how to anticipate market movements and stop using lagging indicatorsthen you will absolutely LOVE our Sniper Trading System.

Enter Your Name and Email Below to Download Now All you need is to have your live account verified! Of course, you need to open a live account USD30 from each Forex Broker Below. Both Forex Brokers have excellent rating!

Save my name, ichimoku forex strategy, email, and website in this browser for the next time I comment. Share Tweet Share Email Whatsapp Print. Download Now! Broker 1 Broker 2 We use both of these brokers and proudly promote them! NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies. Other Analysis Today. Learn and SHARE the Knowledge! This might also interest you Click Here to Leave a Comment Below 2 comments, ichimoku forex strategy.

Leave a Reply: Save my name, email, and website in this browser for the next time I comment. Leave this field empty.

Advanced Ichimoku Trading Strategy for Forex Trading (Beginner and Advanced)

, time: 24:27Best Ichimoku Strategy for Quick Profits

May 20, · Unexpected Finding Of A Winning Forex Trading System replies. MA, Gann and Ichimoku system (profitable system!) 60 replies. Ichimoku Reverse: Winning contest strategy for July 9 replies. Change a losing system into a Winning system 68 Dec 22, · Ichimoku Kinko Hyo – The Power of Trends. Ichimoku is a trading system that originated in Japan. Developed by journalist Goichi Hosoda, it is designed to help you identify and trade with the dominant trend.. The lines look quite complicated on the chart, but you can easily use them as part of an automated trading strategy Jul 09, · The Ichimoku Cloud, otherwise called Ichimoku Kinko Hyo, is a flexible indicator that characterizes support and resistance, distinguishes bias heading, measures momentum, and gives trading signals. Below we will provide you with an idea about Ichimoku Cloud and its basic trading strategy

No comments:

Post a Comment