Apr 21, · How to Trade Using RSI RSI can be used just like the Stochastic indicator. We can use it to pick potential tops and bottoms depending on whether the market is overbought or oversold. Below is a 4-hour chart of EUR/blogger.comted Reading Time: 3 mins Mar 13, · Using RSI in Forex trading is going to tell you if a stock is overbought or oversold. You can also use the RSI to confirm a trend; whether up or down. So just because the RSI has reached overbought or oversold level’s doesn’t mean the stock is going to reverse May 26, · J. Welles Wilder was the man behind the Relative Strength Index (RSI) indicator. He described the tool in his book titled ‘New Concept in Technical Trading System,’ which was released in June It is an indicator that traders use to check the speed and change of the price of a financial asset (which can be a forex pair, stocks, and other securities)

How To Make Money Using 2-Period RSI Strategy

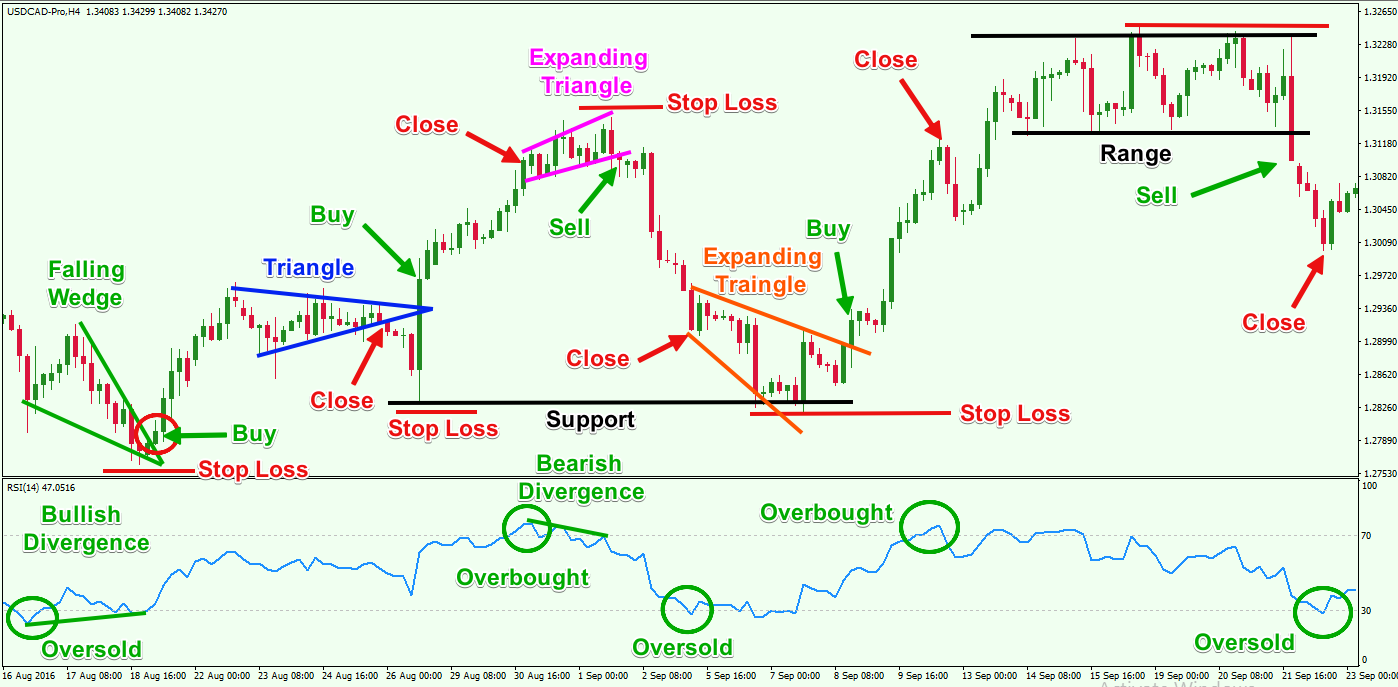

In forex trading, Different indicators help us to see the current market condition in different perspectives. RSI divergence is a very how to trade with rsi in forex trade signal especially when it comes to identifying trend reversal and trading around key levels. In this article, we are going to talk about How to Trade RSI Divergence Profitably by combining it with trend reversal chart pattern. I highly recommend you to read our Ultimate Guide to The RSI Indicatorif you are not familiar with the RSI much.

Read it. A Divergence occurs on your chart when the price action and RSI indicator are out of the sync, how to trade with rsi in forex. Which mean, in a Downtrend market, Price makes a Lower low But the RSI indicator makes higher lows. Basically, a divergence form when the indicator does not agree with the price action and when the situation like this arises, you should pay attention to the market. Have a look at the chart below which explain RSI divergence. According to the above chart, both bullish RSI divergence and the bearish RSI divergence are clear and, the price action actually reversed after both RSI Divergence signals, right?

Since we using RSI indicator for identifying trend reversals, It is very important to identify the right trend reversal, for that first we need to have a trending market then we use RSI divergence to identify right trend reversal. At the beginning of the uptrend, both RSI indicator and Price Action did the same thing by forming higher highs.

This typically indicates that the trend is strong. But at the end of the trend, Price makes higher highs but the RSI indicator formed lower highs which indicate there is something worth watching in this chart.

This is where we need to pay attention to the market, because of both the indicator and price action are out of sync, which means an RSI divergence, right?

In this case, the RSI divergence indicates bearish trend rotation. Have a look at the chart above and observe what happened after the RSI divergence. See, the RSI divergence is very accurate when it comes to identifying trend reversals. But the question is, How to actually catch the trend reversal, right? So what if we combined RSI divergence with another reversal factors like the Head and shoulders pattern, we can increase the probability of our trade, That is great, how to trade with rsi in forex, right?

Related — How to Trade Head and Shoulders Pattern in Forex — A Reversal Trading Strategy. Before thinking about trade entry, we need to have a favourable market condition. Since we are looking for a trend reversal, It is better to have a trending market.

Have a look at the chart below. According to the above chart, you can see that the market was in a strong uptrend but right now the price action starts to slow down. Have a look at the RSI divergence marked in the chart above, how to trade with rsi in forex indicate weaknesses of this uptrend.

Now we confirmed the weakness of this uptrend. Now all the technical factors are aligned. But the question is where to place our sell orders? This is where the head and shoulders pattern marked in the chart above comes into play. Head and shoulders pattern has reversal characteristic hence combining it with the RSI divergence is a great way to improve odds in our favours.

In this case, we used the break of the neckline as our entry trigger. Have a look at the chart below to see what happened after the breakout. Triangle chart pattern comes with two variations, One is Ascending triangle pattern which is works as a reversal pattern in a downtrend. The second one is the descending triangle pattern which acts as a reversal pattern in an uptrend market.

Just like the previous example, the market was in an uptrend and eventually the price start to slow down. At the same time, RSI also signals the divergence. These clues indicate the weaknesses of this uptrend. Now we know that the ongoing uptrend is losing momentum and result of that the price ended up forming a descending triangle pattern. This even confirms the reversal.

Now it is time to execute the short trade. Just like the previous example, we how to trade with rsi in forex the same breakout techniques for this trade as well. Below chart explain how the trade workout after the entry. We wait for a break below the descending the triangle and then place the sell order. As you can see pairing RSI divergence with chart patterns resulted in high profitable trades, how to trade with rsi in forex. Related — Forex Trade Entry Techniques: Learn How to Execute Trades Right Way.

This time we are going to pair trend structure with RSI divergence. The trend is our friend, right? As long as the market is trending, we need to trade in the direction of the trend. This is how professionals teach us. But the trend is not going forever, at some point it is going to reverse, right? We all know that uptrend is forming higher high while the downtrend is forming lower lows. Now with that in mind have a look at the chart below. Now if you look to the left of this chart, you can see that it is a downtrend with a series of lows and lower highs.

Next, have a look at the RSI divergence marked in the chart Red Line. Price action creates Lows but the RSI create higher lows, right? What does this indicate? Even though the market creates low the RSI is doing the opposite thing this indicates ongoing downtrend is losing its momentum and we should prepare for a reversal.

Have a look at the black circle marked in the chart, What happened there? Price broke the previous Lower high and start to create the first high, how to trade with rsi in forex. This indicates that the ongoing downtrend is no longer valid. Now all the technical factor are aligning nicely. As price broke above the previous Lower high, we execute a buy trade by placing stop-loss few pips below the how to trade with rsi in forex level Geen zone.

As you guys can see this trade works really well. Just like the head and shoulders pattern double top and bottom also has the reversal characteristic.

Double top or double bottom is a reversal pattern that is formed after an extended move or after a trend. After hitting that level, the price will retrace lower slightly but then return back to test the previous level again. If the price bounce from that level again, then you have a DOUBLE TOP. have a look at the double top below. This is a strong sign that a reversal is going to happen because it is telling buyers are struggling to continuously go higher.

The same set of principals is applied for the double bottom as well but oppositely. Have look at the chart below. According to the above chart, can see there is a double top that is formed after an extended bullish move.

If you look at the RSI can see that RSI also shows divergence at the same time. If combine RSI divergence and Double top we say that buyers are no longer in control hence we can anticipate a reversal. Right now all the confluences are aligned.

But how to place our orders? In here we use the breakout entry technique. So, in this case, we execute a sell trade after the price broke below the trigger line. After that price hit our take profit within one day. QUICK PROFIT. The same trading techniques are applied for the double bottom as well. Have a look at the chart below which describe how to trade RSI divergence with double bottom.

Study how to trade with rsi in forex above chart try to break it down. Remember that the same principals apply for the double bottom as well. So there you have it — 4 Trade Entry Techniques to Combine with RSI Divergence.

But keep in mind that this is not a HOLY-GRAIL trading strategy. There is no such thing called holy-grail trading strategy and all the trading strategy suffer from losses and they are unavoidable.

We earn consistence profit from this trading strategy BUT we are using tight risk management and a technique to cut our losses quickly. That way we can minimize our drawdown and that open the doors for big upside potential.

Read our article on The Art of Cutting Your Losses Short — Forex Risk Management. Picking right and higher probability trading location is very important. Adding the filter of location can usually always bring your trading strategy to the next level. Instead of taking just based on RSI Divergence and chart patterns, It is better to combine these two factors with highly profitable trade location like support and resistance.

The chart below explains this concept nicely. According to the chart below, you can see the uptrend with two RSI divergences. However, the first divergence Red one marked in the chart is completely failed and the price moved higher.

But the second one resulted in a profit. Why is that?

BEST RSI Trading Strategy For Daytrading Forex [ MUST KNOW ] - RSI Strategy Explained

, time: 8:32How to Use RSI (Relative Strength Index) for Forex Trading | TradingDominance

Enter a trade when you get an RSI signal on the chart – overbought, oversold, or divergence. Enter in the direction of the signal. Put a stop loss order beyond the top/bottom created at the moment of the reversal. Stay in the trade until the RSI gives you an opposite blogger.comted Reading Time: 8 mins Mar 13, · Using RSI in Forex trading is going to tell you if a stock is overbought or oversold. You can also use the RSI to confirm a trend; whether up or down. So just because the RSI has reached overbought or oversold level’s doesn’t mean the stock is going to reverse May 26, · J. Welles Wilder was the man behind the Relative Strength Index (RSI) indicator. He described the tool in his book titled ‘New Concept in Technical Trading System,’ which was released in June It is an indicator that traders use to check the speed and change of the price of a financial asset (which can be a forex pair, stocks, and other securities)

No comments:

Post a Comment