5/11/ · In commodities, supply and demand dictate movement in prices. In Forex markets, significant fluctuations in spot prices are driven mostly by changes in interest rates. On days when central banks announce rate changes, Forex traders can make (or lose) a lot of money. Third, the Forex 5/5(5) 3/17/ · 1. Free weekly Forecast, Professionally developed trading course, and more! Stay on the look out for our weekly Monday forecast, which has proven to be 82% accurate. This Forex Strategy Author: Kleveland 11/25/ · The RSI Stochastic Divergence Strategy is a trend following a strategy that uses multiple technical indicators to spot the best possible trading opportunities. The Stochastic indicator is used to spot hidden divergence which is a more powerful tool than Estimated Reading Time: 8 mins

8 Forex Trading Strategies for - Admirals

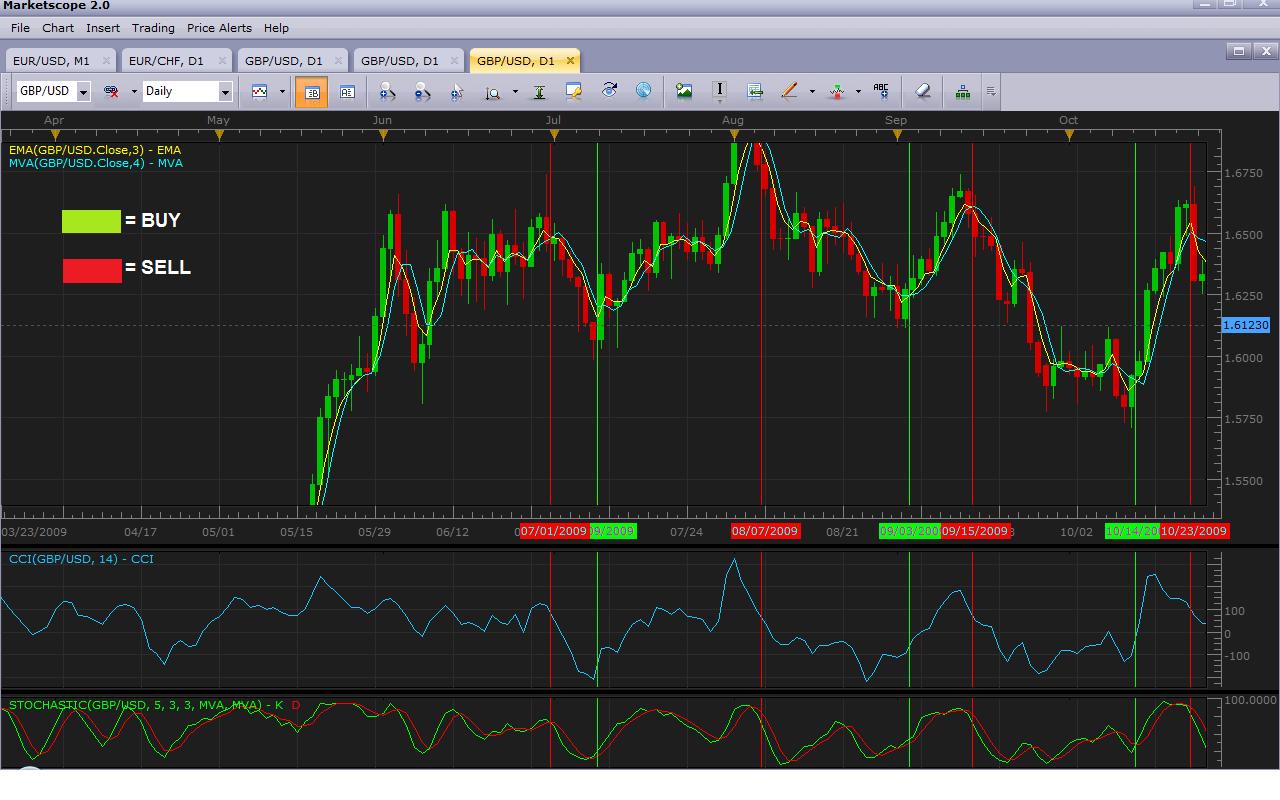

Forex trading can be incredibly intimidating at first glance. Just look at any graph — consisting of bars with protruding lines, they can look like hieroglyphs to the uninitiated. By sitting down with a seasoned trader, though, you can make sense of it all. However, there is more to profitable Forex trading strategies and Forex trading techniques than being able to read a graph. Following the news is of limited help — it is accessible to everyone, so it is already baked into the price.

How is it possible to outperform the market, then? Most tout a framework called technical analysis. It posits that past market behavior is a good indicator of future results. Rookie traders often mistakenly assume that all markets are the same. They are mistaken — Forex exchanges differ considerably compared to those that deal in equities and commodities. First, best technical forex strategy, Forex trading markets are open 24 hours per day, five days a week.

These hours stand in stark contrast to those kept by stock and commodity exchanges — often, they are open only eight hours per day. With the ability to trade around the clock, a position accidentally left open can end badly for an inexperienced trader. Second, different things drive movements in Forex, stock, and commodity prices. Quarterly revenue reports and monthly economic indicators initiate significant moves in the value of shares. In commodities, supply and demand dictate movement in prices.

In Forex markets, significant fluctuations in spot prices are driven mostly by changes in interest rates. On days when central banks announce rate changes, Forex traders can make or lose a lot of money. Third, the Forex market is highly liquid. Every day, five trillion USD changes hands best technical forex strategy compare that to equities markets, where merely billion USD is transferred.

This reality increases volatility in Forex markets, making them a challenging place to trade. So it because upmost important to drill down various parameters through Forex best technical forex strategy analysis, Forex strategies, Forex techniques as well as Forex tips when analyzing or before buying any position in Forex trading.

Most day traders are short-term investors, best technical forex strategy. They set a position and quickly exit it, often best technical forex strategy seconds. Instead, they apply a framework known as technical analysis. What is technical analysis? In short, it is grounded in three principles:.

The market has incorporated all available information into the current price. Prices move in predictable trends. History repeats itself. By applying best Forex technical analysis and strategies, best technical forex strategy, you can look at a pairing and open a position that will be profitable more often than not. Instead, bring up ones that are broken down by the minute or hour.

Second, determine the support and resistance levels. If prices are tracking close to an established resistance level over a few hours of forex trading, going long is likely a bad bet. Third, pay attention to volume.

Volume represents the actual amount of currency changing hands. For instance, if volume is low, a sharp rise in prices should not be taken seriously.

If it is high, however, it could be indicative of a real trend. Catching on fast? If technical analysis is as rock-solid as its proponents claim, why do Forex forecasters get it wrong? All markets, best technical forex strategy, generally speaking, are unpredictable.

All it takes is an unexpected rise in interest rates, a natural disaster, or the sudden best technical forex strategy of an industry to throw a monkey wrench into forecasts.

All we can do state the probability of a given outcome. For every predictions they make, they get calls wrong. Forex trading is a game filled with ups and downs.

It is also advisable to grab as much as knowledge you can based on forex technical analysis, forex fundamental analysis along with various best technical forex strategy strategies and forex techniques.

Vote count: 5. No votes so far! Be the first to rate this post. So, thanks for sharing it. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Skip to content Home Investing Investment Forex and Currencies Best Forex Technical Analysis — Strategies, Techniques and Forex Tips. Contents 1 Difference Between Forex Vs Stocks Vs Commodity Market: 2 The importance of Technical Analysis in Forex Trading: 3 Why do Forex forecasts get movements wrong so often?

How useful was this post? Click on a star to rate it! We are sorry that this post was not useful for you! Let us improve this post! Tell us how we can improve this post? Submit Feedback.

Leave a Comment Cancel Reply Your email address will not be published.

The Easiest Forex STRATEGY! You must watch! ��

, time: 12:36Top 20 Best Forex Trading Strategies that Work Even for Beginners

11/25/ · The RSI Stochastic Divergence Strategy is a trend following a strategy that uses multiple technical indicators to spot the best possible trading opportunities. The Stochastic indicator is used to spot hidden divergence which is a more powerful tool than Estimated Reading Time: 8 mins 4/10/ · Forex Profit Heaper Strategy. 4. Forex Radar Signal Trading Strategy. 5. Forex Bandit Flash Forex Trading Strategy. 1. CAP Channel Indicator. CAP Channel Indicator is an exceptionally effective trend based indicator. It is based on the concept that market prices will fluctuate inside a Estimated Reading Time: 4 mins 5/3/ · Pips a Day Forex Strategy. One of the latest Forex trading strategies to be used is the pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. The GBPUSD and EURUSD currency pairs are some of Estimated Reading Time: 9 mins

No comments:

Post a Comment