2/19/ · Margin and leverage are two sides of the same coin. Margin is the minimum amount of money required to place a leveraged trade, while leverage Estimated Reading Time: 4 mins 4/14/ · Margin is the amount of money needed as a “good faith deposit” to open a position with your broker. Margin is usually expressed as a percentage of the full amount of the position. For example, most forex brokers say they require 2%, 1%,.5% or% blogger.comted Reading Time: 4 mins 10/14/ · Margin is calculated based on the leverage. But to understand the margin, let’s forget about the leverage for now and assume that your account is not leveraged or its leverage is indeed. “Required Margin” is the amount of the money that gets involved in a position or trade as collateral

Forex Leverage and Margin Explained - blogger.com

Forex margin rates are usually expressed as a percentage, with forex margin requirements typically starting at around 3, what is margin in forex. Margin is the amount of money that a trader needs to put forward in order to open a trade. When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade. Margin is one of the most important concepts to understand when it comes to leveraged forex tradingand it is not a transaction cost.

Margin is a percentage of the full value of a trading position that you are required to put forward in order to open your trade. Margin trading enables traders to increase their exposure to the market. This means both profits and losses are amplified. Trading forex on margin enables traders to increase their position size. Margin allows traders to open leveraged trading positionsgiving them more exposure to the markets with a smaller initial capital outlay, what is margin in forex.

Remember, margin can be a double-edged sword as it magnifies both profits and losses, as these are based on the full value of the trade, not just the amount required to open it. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example.

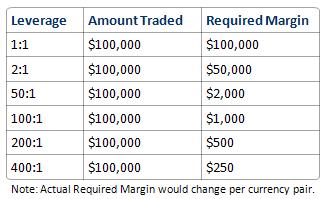

Margin requirements differ depending on forex brokers and the region your account is based in, but usually start at around 3. For example, if a forex broker offers a margin rate of 3. The remaining The leverage on the above trade is As trade size increases, so does the amount of margin required. Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be used to calculate the margin level.

So margin level is the ratio of equity in the account to used margin, expressed as a percentage. The formula to calculate margin level is as follows:. Learn more about calculating CFD margins. The higher the margin level, what is margin in forex, the more cash is available to use for additional trades. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions.

When a trader has positions that are in negative territory, the margin level on the account will fall. With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push notification.

Traders should avoid margin calls at all costs. Margin calls can be avoided by monitoring margin level on a regular what is margin in forex, using stop-loss orders on each trade to manage losses and keeping your account adequately funded. Margined trading is available across a range of investment options and products.

One can take a position across a wide variety of asset classes, what is margin in forex, including forex, stocks, what is margin in forex, indices, commodities and bonds. Explore our markets page. Another concept that is important to understand is the difference between forex margin and leverage. Forex margin and leverage are related, but they have different meanings.

We have already discussed what forex margin is. It is the deposit needed to place a trade and keep a position open. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay.

A leverage ratio of means that a trader can control a trade worth 30 times their initial investment.

In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade.

So, if the forex margin is 3. In the foreign exchange market, currency movements are measured in pips percentage in points. A pip is the smallest movement that a currency can make.

However, at the same time, leverage can also result in larger losses. Leverage increases risk, and should be used with caution. Leveraged trading is a feature of financial derivatives trading, such as spread betting and CFD trading. Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually.

To calculate forex margin with a forex margin calculator, a trader simply enters the currency pairthe trade currency, the trade size in units and the leverage into the calculator. The forex margin calculator will then calculate the amount of margin required. The currency pair is trading at 1. Forex margin calculators are useful for calculating the margin required to open new positions.

They also help traders manage their trades and determine optimal position size and leverage level. Position size management is important as it can help what is margin in forex avoid margin calls.

Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysisas well as risk managementso you can better analyse price action and protect yourself from sudden market movements.

Seamlessly open and close trades, track your progress and set up alerts. In leveraged forex trading, margin is one of the most important concepts to understand. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position.

Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is what is margin in forex. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable.

Traders should take time to understand how margin works before trading using leverage in the foreign exchange market. Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required. See our beginners guide to trading forex to help you get started or open a what is margin in forex trading account.

Disclaimer: CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, what is margin in forex, and what is margin in forex not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

See why serious traders choose CMC. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Personal Institutional Group.

Australia English 简体中文. Canada English 简体中文. New Zealand English 简体中文. Singapore English 简体中文. United Kingdom. International English 简体中文. Start trading. Products Ways you can trade CFDs Spread betting What you can trade Forex Indices Cryptocurrencies Commodities Shares Share baskets Treasuries ETF trading Product details CFD spreads and commissions CFD margins CFD other costs CFD rebates.

Latest news Economic calendar Highlights Featured chart Our market analysts Michael Hewson David Madden. Learn CFD trading What are CFDs? Benefits of trading CFDs Risks of CFD trading CFD trading examples CFD holding costs Learn cryptocurrencies What is bitcoin? What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies?

The advance of cryptos. Help topics Getting started FAQs Account applications FAQs Funding and withdrawals FAQs Platform FAQs Product FAQs Charges FAQs Complaints FAQs Security FAQs Glossary Contact us FAQs How can I reset my password?

How do I fund my account? How do I place a trade? Do you offer a demo account? How can I switch accounts? CFD login. Log in. Home Learn Learn forex trading Margin in forex trading. What is margin in forex? See inside our platform. Get tight spreads, no hidden what is margin in forex and access to 11, instruments.

Start trading Includes free demo account. Quick link to content:.

Is Forex Trading Halal or Haram fatwa stock market by Dr Zakir Naik Is buying shares haram in islam

, time: 5:52What is Margin? - blogger.com

What is Margin Call in Forex. Think of the margin call level, as a safety mechanism. It is a threshold for the margin level that, when reached, means that you are at high risk of having some or all of your positions liquidated or forcibly closed. “Margin level” is 10/14/ · Margin is calculated based on the leverage. But to understand the margin, let’s forget about the leverage for now and assume that your account is not leveraged or its leverage is indeed. “Required Margin” is the amount of the money that gets involved in a position or trade as collateral In Forex trading, margin is the amount you need to deposit or have deposited in your account, to access leverage or maintain a leveraged position

No comments:

Post a Comment