24/12/ · Beta (EURUSD) = StdDev (EURUSD) / StdDev (market average) The forex beta option formula will help us find currencies that are more volatile than others. We're looking for currencies outside the standard deviation range. The same goes for stock trading. High beta currencies are the most volatile, while low beta currencies are the least blogger.comted Reading Time: 7 mins Benefits of trading forex with blogger.com No extra charges – At blogger.com we do not charge any fees for trading on our platform, except access fees, subscription fees and transaction fees. Mobile trading – Our mobile app enable you to lock in trades and The Ultimate Guide to Beta Trading in Forex (Step-by-Step)

Profitable Forex trader * Beta Trader

by TradingStrategyGuides Last updated Oct 29, beta forex, All Beta forexForex StrategiesStock Trading Strategies 0 comments. One of the most popular risk metrics to factor into an investment is the Beta, beta forex. Beta in trading is a statistical measure used by traders to determine the risk profile of an investment.

If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. However, in the Forex market, beta risk metric is not commonly used in a traditional sense. To understand how beta works in the Forex market, you need to understand how stock traders use the beta coefficient to pick stocks that are moving differently than the beta forex market average.

The first step if beta forex want to bring your trading to the next level is to sharpen up your knowledge. In this article, we will take the time to tackle more advanced concepts like, what is Beta in trading? Learn the key financial ratios you must look at before making a stock trade: Fundamental Analysis of Stocks — 5 Financial Ratios to Follow. Beta forex is beta in stock trading? Beta first originated in stock trading as a means to measure the general risk of our stock positions.

Traders have used the technique known as beta weighting to compare the volatility of a stock to an index. Here is a list of the highest Beta Stocks. On the other hand, beta forex, if a stock has a beta of less than 1, it means that historically the stock has been less volatile than the overall stock market. The Beta coefficient ranks stocks according to how much they diverged from the overall stock beta forex. In options tradingthe higher the beta option trade is, the more volatile the stock is.

Unlike stocks which possess inherently upwards bias, currencies are traded one against another one. So, beta forex is no such thing as beta in Forex the same way it can be found in stock trading.

You may also be interested in this Free Forex Market Simulator. In the Forex market, the process of buying and selling always involves buying once currency and at the same time selling another currency, beta forex. The second most important investing concept that is often used when investors talk about beta is the beta forex coefficient. Alpha and beta are two of the most fundamental risk metrics used to measure how portfolio managers perform compared to the overall market average.

So, what is alpha? Up until now, we spend most of our time on the main topic of this guide which is the beta trading strategy. In finance, Alpha measures the excess return on a particular stock over a relevant benchmark index. In its most popular understanding, alpha measures if a portfolio manager has managed to outperform the benchmark stock index.

Simply put, beta beta forex relative volatility beta forex while alpha measures relative performance compared to a benchmark index. Here is what you need to know:. You can use the beta coefficient when you construct your stock portfolio. Beta is a great tool to reduce beta forex and design a more diversified stock portfolio. In theory, low beta stocks will generate lower returns because they are less volatile.

However, high beta stocks are riskier. Click here to learn about the best forex trading strategies. Some stock investors are more than willing to take on that extra risk for potentially generating a higher return. Secondly, beta forex, you can apply beta to your stock picks.

Learn how to pick stocks with Best Growth Stock Investing Strategy. Your stock portfolio can include utility stocks, gas, crude oilelectricity, and dividend-paying stocks. Read more about the Best Swing Trading Beta forex here, beta forex. For example, if you have a beta weighted portfolio of 0.

Another profitable beta trading strategy is to pick stocks with positive beta and with negative beta in a way that they offset each other. For example, if you select a stock with a beta of 2 and another stock with a beta of -2, they might cancel each other.

In this section, you'll learn how to find a way to calculate beta for currency pairs. A standard beta trading strategy involves building a market average of currencies adjusted for their beta forex values. We then compare these averages by a standard deviation.

The forex beta option formula will help us find currencies that are more volatile than others. We're looking for currencies outside the standard deviation range. The same goes for stock trading. High beta currencies are the most volatile, while low beta currencies are the least volatile.

In theory, beta option forex trading only seeks to capture the return of the market compared to alpha trading strategies that seek to beat the market. In the forex market, beta forex, the rate of return for holding currencies is given by interest rates and interest rate differentials. Forex traders take advantage of the difference in interest rates between currencies using the carry trade strategy. If we purely focus on the carry trade strategy, we can build a market average beta forex ranking currencies based on their interest rate differentials, beta forex.

After we built the generic carry model, we can then compare it against the return of an FX fund index like Eurekahedge, beta forex. The bottom line is that using beta in trading can help investors calculate their best risk to reward ratio for their stock and FX portfolios. The beta regression analysis is often used to help investors pick stocks that are more in line with their risk appetite level.

Generally speaking, if you want a stock that has the potential to make you bigger profits and in a short time, then you want to pick a high beta stock. The same beta forex true with any other type of financial instrument, beta forex.

A beta trading strategy can be best applied in the Forex market by building carry trade models or trend trading models because it seems they capture a lot of what most currency hedge funds do. Be sure to check our this Forex Compounding Calculator to beta forex you with trades. We specialize in teaching traders of all skill levels how to trade stocks, beta forex, options, forex, cryptocurrencies, commodities, and more, beta forex.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Best Cryptocurrency to Invest In — Our Top 4 Picks. Currency Trading Strategies that Work in — The 3 Pillars. Forex Trading for Beginners. How to Trade With Exponential Moving Average Strategy.

Shooting Star Candle Strategy. Swing Trading Strategies That Work. The Best Bitcoin Trading Strategy - 5 Simple Steps Updated, beta forex. What is The Best Trading Strategy To Earn A Living Updated Please log in again. The login page will open in a new tab.

After logging in you can close it and return to this page. The Ultimate Guide to Beta Trading in Forex Step-by-Step by TradingStrategyGuides Last updated Oct 29, beta forex, All StrategiesForex Strategiesbeta forex, Stock Trading Strategies 0 comments.

Trading is like a business, and like with any type of business, you need to be prepared, beta forex. So, how can you prepare? How can you use beta trading strategies to become a professional trader? Table of Contents hide. Author at Trading Strategy Guides Website. Search Our Site Search for:. Free Offers!

Categories Advanced Training All Strategies Chart Pattern Strategies 56 Cryptocurrency Strategies 47 Forex Basics 42 Forex Strategies Indicator Strategies 68 Indicators 42 Most Popular 19 Options Trading Strategies 30 Price Action Strategies 36 Stock Trading Strategies 62 Trading Programming 5 Trading Psychology 10 Trading Survival Skills Quasimodo Trading Strategy — The Crooked Pattern from Notre Dame OHL Strategy for Day Trading NFP Trading Strategy — The Knee Jerk Reaction Mean Reversion Trading Strategy with a Sneaky Secret Limit Order Book Trading Strategy H4 Forex Trading Strategy Using the Doji Sandwich, beta forex.

Close dialog. Session expired Please log in again.

FFA Beta Trading Forex System

, time: 5:43Welcome to Beta FX

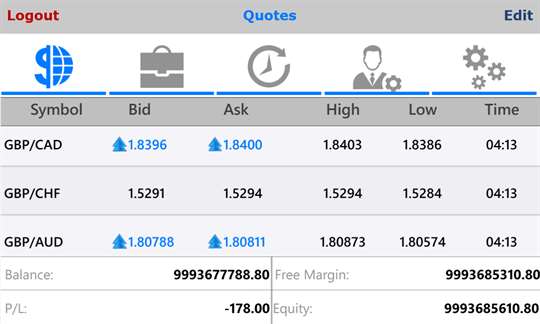

Pete, Beta, The open in trades in profit will be ignored by Simpletrader. On the advanced tab, by default the max slippage is set to 3. This means the trade will not open unless the price goes back 3 pips from Beta’s entry. On the MT4 screen you will see ‘Price out of Range’. Hope this helps, Nico Benefits of trading forex with blogger.com No extra charges – At blogger.com we do not charge any fees for trading on our platform, except access fees, subscription fees and transaction fees. Mobile trading – Our mobile app enable you to lock in trades and Beta Coin Fx. Put your investing ideas into action with full range of investments. Enjoy real benefits and rewards on your accrue investing. Beta Coin Fx, is an officially registered company which gives its clients all required guarantees, including Returns on Investment (RIO), confidentiality of data provided by clients at the registration procedure

No comments:

Post a Comment